Re-thinking Market Access – Introduction and Overview

CapSys Group‘s latest global study, Re-thinking Market Access, confirms that the challenges faced by the global pharmaceutical and life sciences industries as a result of external trends continue to intensify. Although bringing products to patients and gaining access should be the responsibility of the whole organization, Market Access teams carry the largest burden in terms of addressing payer expectations, evidence requirements, pricing pressures, cost–effectiveness of assets and market competition. Organizations and their Market Access teams are having to re-evaluate their working strategies to address these growing demands. Based on the input of Market Access leaders, CapSys has identified six success requirements to achieve Market Access Excellence in today’s competitive environment.

Re-thinking Market Access is a global study by CapSys that aims to understand the current challenges and trends faced by the Market Access function. The study distills implications and levers of success for organizations on a strategic and practical level. CapSys then provides a systematic approach, framed by the success levers, to assess performance and develop solutions to overcome the challenges.

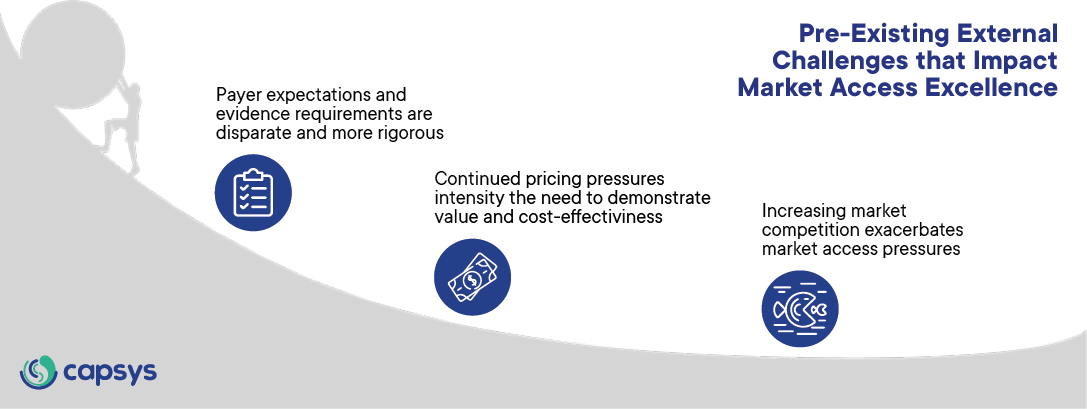

Through interviews with global and regional Market Access experts and key opinion leaders (KOLs) from pharmaceutical and life sciences organizations, CapSys identified the three primary and most challenging external trends for the Market Access function. Although they are well known, these market trends are becoming increasingly demanding, requiring stringent assessment and development of a targeted and concerted response by organizations and their market access specialists.

Major External Challenges Facing Market Access are Well-Known but Increasingly Demanding

Figure 1: Pre-Existing challenges that impact Market Access Excellence. CapSys Group

Trend 1: Continued cost pressures intensify the need to demonstrate value and cost-effectiveness

Increased healthcare utilization – due to population growth, an aging population, increased prevalence of chronic diseases, and the COVID-19 pandemic – has led to increased healthcare costs. In addition, innovations and an emphasis on personalized care and specialty medicines are also contributing to the inflation in healthcare service costs and rising drug prices. These factors lead to burgeoning healthcare expenditures, forcing underfunded, under-resourced and overburdened payers or healthcare systems to face difficult decisions, become increasingly cost-conscious and apply cost-containment and/or drug rationing measures.

Payer or healthcare systems accomplish this in different ways and therefore their requirements vary across countries and regions. Some markets (e.g. the UK) require demonstration of cost-effectiveness, while others (e.g. Germany) focus on added therapeutic benefit. Organizations are under pressure to provide more substantial evidence to justify their prices, and increasingly face tougher negotiations with payers, who are demanding more attractive or flexible pricing and payment models, such as value-based and outcomes-based payments. Even the US, which in principle has free drug pricing, has now opened the door for Medicare to negotiate prices.

Consequently, pharmaceutical and life sciences organizations face increasing pressure to reassess their market access strategies and/or evaluate their internal effectiveness.

Trend 2: Increasing market competition exacerbates market access pressures

As payers are adopting more restrictive practices, these challenges arise in increasingly crowded and saturated markets where new innovative drugs face generic competition and compete for smaller patient populations with high unmet needs, such as rare diseases. Identifying or addressing a clear unmet need, showing product differentiation or demonstrating added benefits is more difficult in these scenarios. With payer and healthcare systems incentivizing the development and uptake of generics and biosimilars, there is growing pressure on brand product manufacturers to prove the superiority of their therapies over the alternatives.

Trend 3: Payer expectations and evidence requirements are disparate and more rigorous

To receive coverage from payers, assets must demonstrate additional evidence beyond the clinical data required for regulatory approval. This can include additional medical, societal, economic, or quality of life benefits, or cost-effectiveness, compared to the current standard of care. Further, evidence requirements differ from payer to payer across reimbursement systems and geographies. Therefore, evidence requirements for regulatory approval can differ substantially from those required to address payer or Health Technology Assessment (HTA) needs, and in some cases the requirements may be difficult to reconcile in a cost-effective way. Organizations need to gain insights to understand how payers will evaluate their data. Further, they need to identify potential evidence gaps and must develop well thought through and diligently planned evidence generation strategies to address these demands early on in the lifecycle of a drug. For example, early and continuous collaboration between Market Access and Clinical teams can ensure clinical trials are designed to also address payer stakeholders’ requirements.

With new, innovative and higher-cost products constantly entering markets, payer expectations are becoming more demanding and evidence requirements even more rigorous. With increasing complexity of therapies in some disease areas, such as onco-hematology and rare diseases, payer or HTA appraisal processes may also become more challenging or require longer timelines.

However, HTA appraisal methods have not evolved at the same pace as innovation in certain disease areas, e.g. when oncology therapies are showing early positive outcomes in Phase II trials, but still have immature overall survival data. Engaging with payers to jointly evolve and shape appraisal methods is vital to ensure patients have timely access to these therapies.

Organizations and their Market Access functions face significant market access hurdles to adequately demonstrate and communicate the value of their products. The rising scrutiny from payers adds pressure to generate the right quality and quantity of evidence while at the same time addressing market-specific requirements.

Early planning and preparation are essential for optimal payer acceptance and coverage and optimizing access conditions.

The Six Success Requirements that Experts Advocate for Market Access Excellence

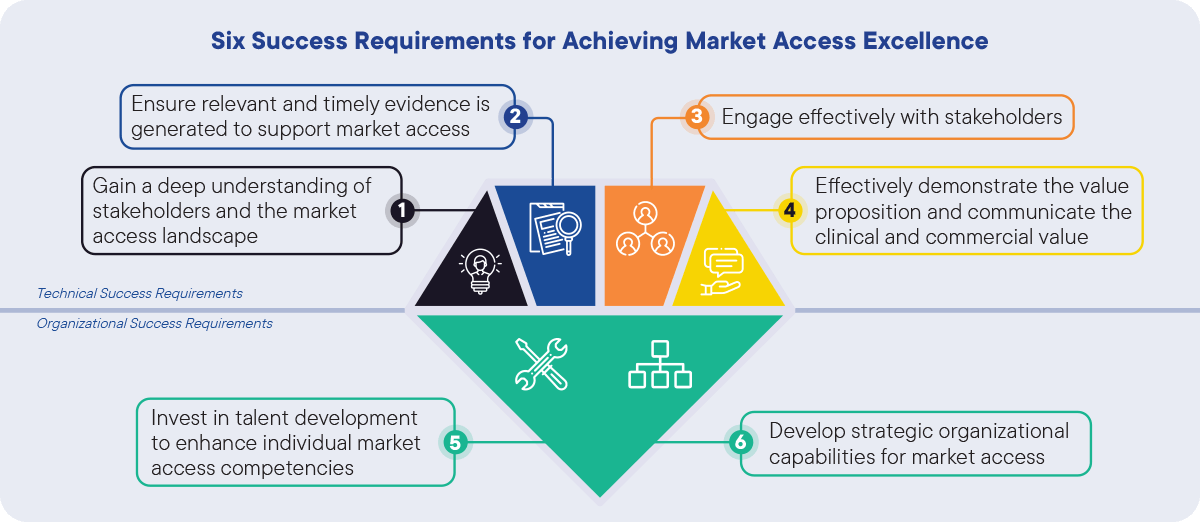

The Market Access function plays a pivotal role in a product’s commercial success and should be best positioned to seize market access opportunities and overcome market challenges. CapSys identified six technical and organizational success requirements to enable Market Access functions to strategically evaluate and respond to the external challenges and achieve Market Access Excellence in this rapidly evolving landscape (Figure 2):

Figure 2: Six Success Requirements for Achieving Market Access Excellence. CapSys Group

Our study identified four technical success requirements that are crucial to achieving excellence in Market Access:

- Gain a deep understanding of stakeholders and the Market Access landscape

- Ensure relevant and timely evidence is generated to support Market Access

- Engage effectively with stakeholders

- Effectively demonstrate the value proposition and communicate the clinical and commercial value

Effectively demonstrate the value proposition and communicate the clinical and commercial value

In addition, two organizational success requirements form the fundamental basis for these technical success requirements:

- Invest in talent development to enhance individual market access competencies

- Develop strategic organizational capabilities for market access

Implementing these six success requirements will be paramount in enabling pharmaceutical and life sciences organizations and their Market Access teams to address market pressures and achieve Market Access Excellence. Within the Re-thinking Market Access series, we will give more detailed insights on the current shortcomings and provide practical examples and indications on how the success requirements can be achieved. Sign up here to receive upcoming articles in this series.

The 'Re-thinking Market Access' Series of Insights

This is the first in a series of eight insight articles based on CapSys‘ global Re-thinking Market Access study and focused on Market Access Excellence in pharma and life sciences. The six following insight articles (Insights 1–6) provide key content and food for thought on the six success requirements for Market Access Excellence, including common shortcomings and improvement opportunities. The final article in the series (Summary and conclusions) provides a framework and (self-)assessment tool, the Market Access Excellence Canvas, to assess your organization’s maturity level and potential gaps to close on the journey to achieve Market Access Excellence. Sign up here for upcoming articles in the Re-thinking Market Access series.

The Re-thinking Market Access study aims to understand the challenges and trends that the Market Access function is facing today, derive implications and levers of success, both on a strategic and operational level. It provides a systematic approach to assess performance and develop solutions to overcome the challenges. The study was conducted through interviews with industry experts and key opinion leaders in Market Access, from small to large pharmaceutical and life sciences organizations. Contributors had broad therapeutic area expertise, including oncology, orphan diseases, and dermatology.

There is a wealth of additional insights from the conducted expert interviews. If you want an in-depth discussion on the gathered insights or a conversation on the implications for your company, please get in touch with our CapSys experts, Patrick Koller and Kenneth Weissmahr.